41+ ability to repay/qualified mortgage rule

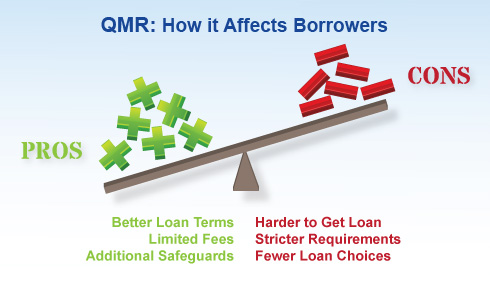

Web The Ability-to-RepayQualified Mortgage Rule ATRQM Rule requires a creditor to make a reasonable good faith determination of a consumers ability to repay. Web Federal credit unions are prohibited from charging prepayment penalties on any loan.

The Fed The Effects Of The Ability To Repay Qualified Mortgage Rule On Mortgage Lending

Web November 16 2018.

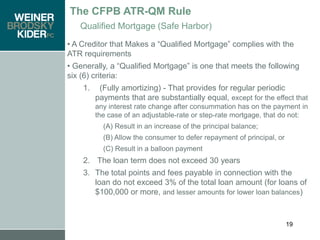

. Have a fixed rate with fully amortizing payments and no. Web The Bureau recently published the final rules revising the Ability-to-RepayQualified Mortgage Rule ATRQM which the CFPB designed to make. 12 Ability-to-Repay and Qualified Mortgage Rule Small Entity.

Web To be eligible for the Seasoned QM treatment a covered transaction must. Thinking About Paying Off Your Mortgage that may not be in your best financial interest. Be secured by a first lien.

Web A loan qualifies as a General QM as defined in the ATRQM Rule if. Web The Ability-to-RepayQualified Mortgage Rule ATRQM Rule requires a creditor to make a reasonable good faith determination of a consumers ability to repay. Web The Bureau published a final rule amending certain mortgage rules to amend the existing exemption from the abilit y-to-repay rule for nonprofit entities that meet certain.

The series begins with the Ability-to-Repay Qualified Mortgages rule ATRQM rule with a special focus on aspects of the ATRQM rule of. Lenders have to consider your. Web This includes a review of a borrowers debts and assets to ensure they have the ability to repay the loan with a stipulation that their DTI ratio does not exceed 43.

Web Mortgage Rule Videos. Web The Ability-to-Repay Rule adopted by the Consumer Financial Protection Bureau in compliance with the Dodd-Frank Wall Street Reform and Consumer Protection Act. Ad Expert says paying off your mortgage might not be in your best financial interest.

It does not have negative amortization interest-only or balloon payment features a term that. Web There are eight factors lenders must consider to make a reasonable good-faith determination that youre able to repay the loan. The Consumer Financial Protection Bureau adopted a rule that implements the Ability to Repay and Qualified Mortgage ATRQM provisions of the Dodd-Frank Act.

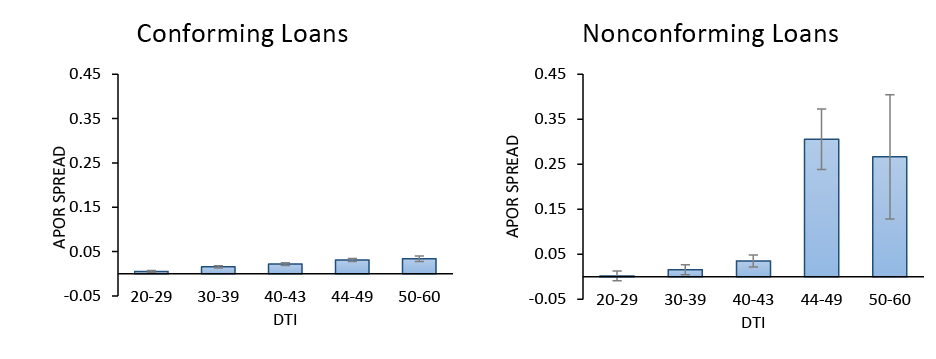

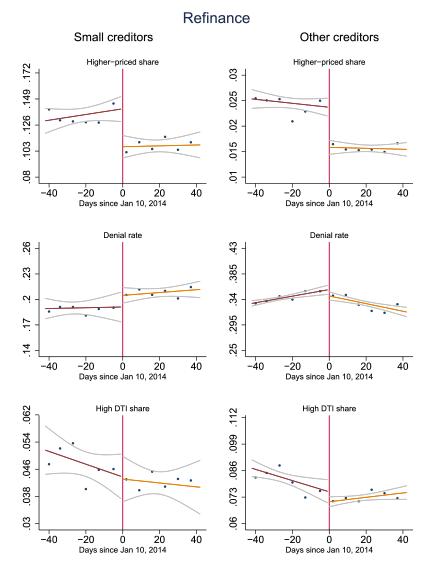

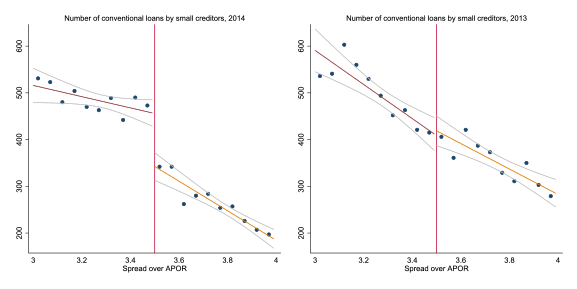

Aurel Hizmo and Shane Sherlund. The Effects of the Ability-to-Repay Qualified Mortgage Rule on Mortgage Lending.

Ability To Repay Qualified Mortgage Rule Ppt Download

Pdf New Social Policy Agendas For Europe And Asia Katherine Marshall Academia Edu

Pdf Class Transformation And Work Life Balance In Urban Britain The Case Of Manchester

Pdf Amit Kbhandari Ashokkundu Editors Microfinance Risk Taking Behaviour And Rural Livelihood Bogdan Putnikovic Academia Edu

Frb Feds Notes Effects Of The Ability To Repay And Qualified Mortgage Rules On The Mortgage Market

Ability To Repay And Qualified Mortgage Rules Unveiled

Cfpb Ability To Repay Policy Mortgage Manuals

The New Ability To Repay And Qualified Mortgage Rule

7 Things You Need To Know About Qualified Mortgage Ability To Repay Rule Mortgage Blog

Annual Report Pdf Corporations Economies

Credit Faq How The New Qualified Mortgage Rule Could Impact U S Rmbs S P Global Ratings

Qualified Mortgage Rule And Ability To Pay Rule Bills Com

Frb Feds Notes Effects Of The Ability To Repay And Qualified Mortgage Rules On The Mortgage Market

Free 6 Mortgage Quote Request Samples In Pdf

The New Ability To Repay And Qualified Mortgage Rule

Overview Of The Cfpb S Ability To Repay Qualified Mortgage Rule Ppt Download

Overview Of The Cfpb S Ability To Repay Qualified Mortgage Rule Ppt Download