20+ ky payroll calculator

Important note on the salary paycheck calculator. Ad Compare This Years.

Kentucky Paycheck Calculator Tax Year 2022

So the tax year 2022 will start from July 01 2021 to June 30 2022.

. This free easy to use payroll calculator will calculate your take home pay. The state tax year is also 12 months but it differs from state to state. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Every first Saturday in May. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Supports hourly salary income and multiple pay frequencies.

Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. Simply enter their federal and state W-4 information as.

How to calculate annual income. The Kentucky Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Kentucky State. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Important note on the salary paycheck calculator. The maximum an employee will pay in 2022 is 911400.

To estimate a paycheck begin with the total annual salary amount in addition to divide by the particular quantity of pay durations in the year. All other pay frequency inputs are assumed to. Free Kentucky Payroll Tax Calculator and KY Tax Rates.

For example if an employee earns 1500. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. Some states follow the federal tax year some.

Calculate your Kentucky net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state. Kentucky Payroll Tax Rates. 20 ky payroll calculator Minggu 23 Oktober 2022 Edit.

Calculating your Kentucky state income tax is similar to the steps we listed on our Federal paycheck calculator. Kentucky Salary Paycheck Calculator. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Kentucky.

Kentucky Hourly Paycheck Calculator. Beranda 20 calculator ky payroll.

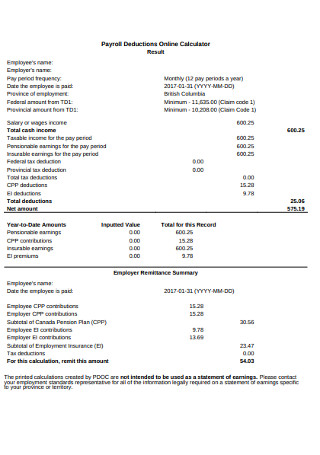

21 Sample Payroll Templates Calculators In Pdf Ms Word Excel

How To Calculate Payroll Taxes Wrapbook

Firstsource Solutions Usa Medical Claims Examiner Resume Sample Resumehelp

Kentucky Salary Calculator 2022 Icalculator

Paycheck Calculator Take Home Pay Calculator

Kentucky Paycheck Calculator Smartasset

How To Calculate Severance Pay 7 Steps With Pictures Wikihow

Crypto Calculator Bitcoin Kanalcoin

How To Calculate Severance Pay 7 Steps With Pictures Wikihow

Kentucky Hourly Paycheck Calculator Paycheckcity

Kentucky Food Stamps Eligibility Guide Food Stamps Ebt

Kentucky Paycheck Calculator Smartasset

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Transportation Coordinator Resume Samples Qwikresume

Difference Between A Manual Payroll System And A Computerised Payroll System Quora

Canadian Payroll Calculator How To Calculate Your Payroll Knit People Small Business Blog

250 Wages Administration Stock Photos Free Royalty Free Stock Photos From Dreamstime